No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

The two firms’ fortunes diverge in Q1 after similar 2023 growth rates

Germany’s two largest premium automakers both saw growth of their global new BEV sales in 2023 of almost 75pc. But the similarities in their trajectories ended in Q124.

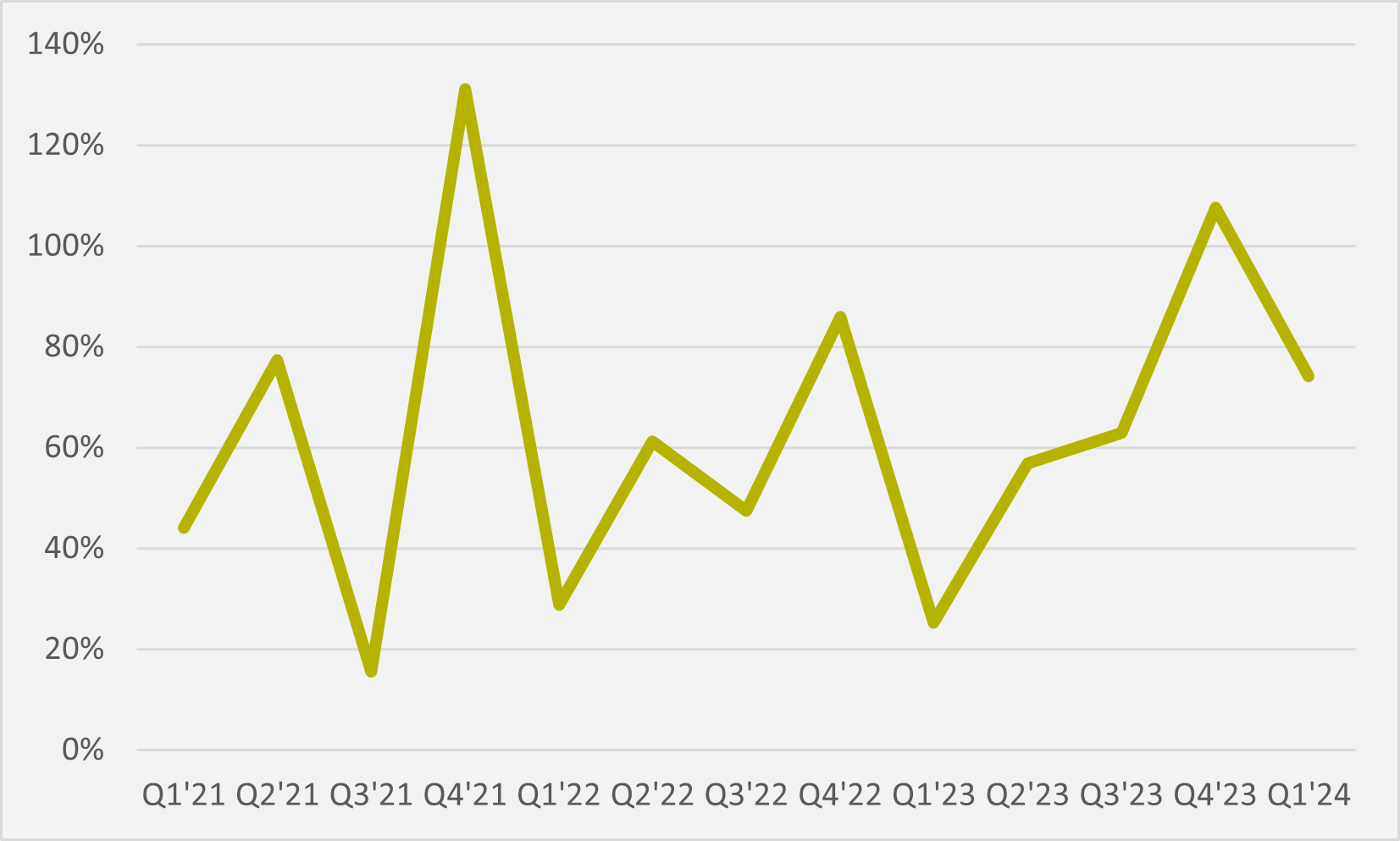

Bavaria’s BMW Group continued its upward momentum with Q1 all-electric sales rising by another 28pc year-on-year to 82,700. It did, though, see a third consecutive quarter where annual growth has slowed (see main image).

Its core BMW brand is the major driver in this growth, with 78,691 fully-electric BMWs delivered to customers worldwide — an increase of 40.6pc compared to the prior year. This suggests that the firm sold fewer all-electric Minis in Q1 compared to the same period last year.

BMW anticipates only a slight increase in overall deliveries in 2024. But it expects BEVs, as well as models from the high-end premium segment, to outperform the rest of the portfolio by posting “significant double-digit growth” this year.

Weaker performer

In contrast to its rival across the Bavaria/Baden-Wuerttemberg state border, Mercedes’ BEV sales fell by 8pc year-on-year to 47,500 units. For a fourth consecutive quarter, BMW sold at least 50pc more all-electric vehicles than Mercedes, although the gap in Q1 actually narrowed from Q4 where BMW outsold Mercedes by more than two-to-one (see Fig.1).

The firm blames the fortwo, the all-electric two-seater made by its 50pc-owned joint venture Smart, reaching the end of its lifecycle for the drop in BEV sales. Smart fortwo sales were down by c.30pc annually in Q1.

It also notes that, in Germany, “consumer demand for BEVs slowed following the abrupt end of a tax incentive”. But, while overall German Q1 all-electric sales fell by 14pc, Mercedes Group BEV sales in Germany in Q1’24 actually increased by 8.7pc, with Mercedes brand deliveries up by 5.9pc and Smart by 14.9pc.

BMW grew Q1 German all-electric sales by 22pc. But, as globally, it was a tale of two brands — with 84pc year-on-year growth for BMW but a 79pc decline for Mini.

Insider Focus LTD (Company #14789403)