No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

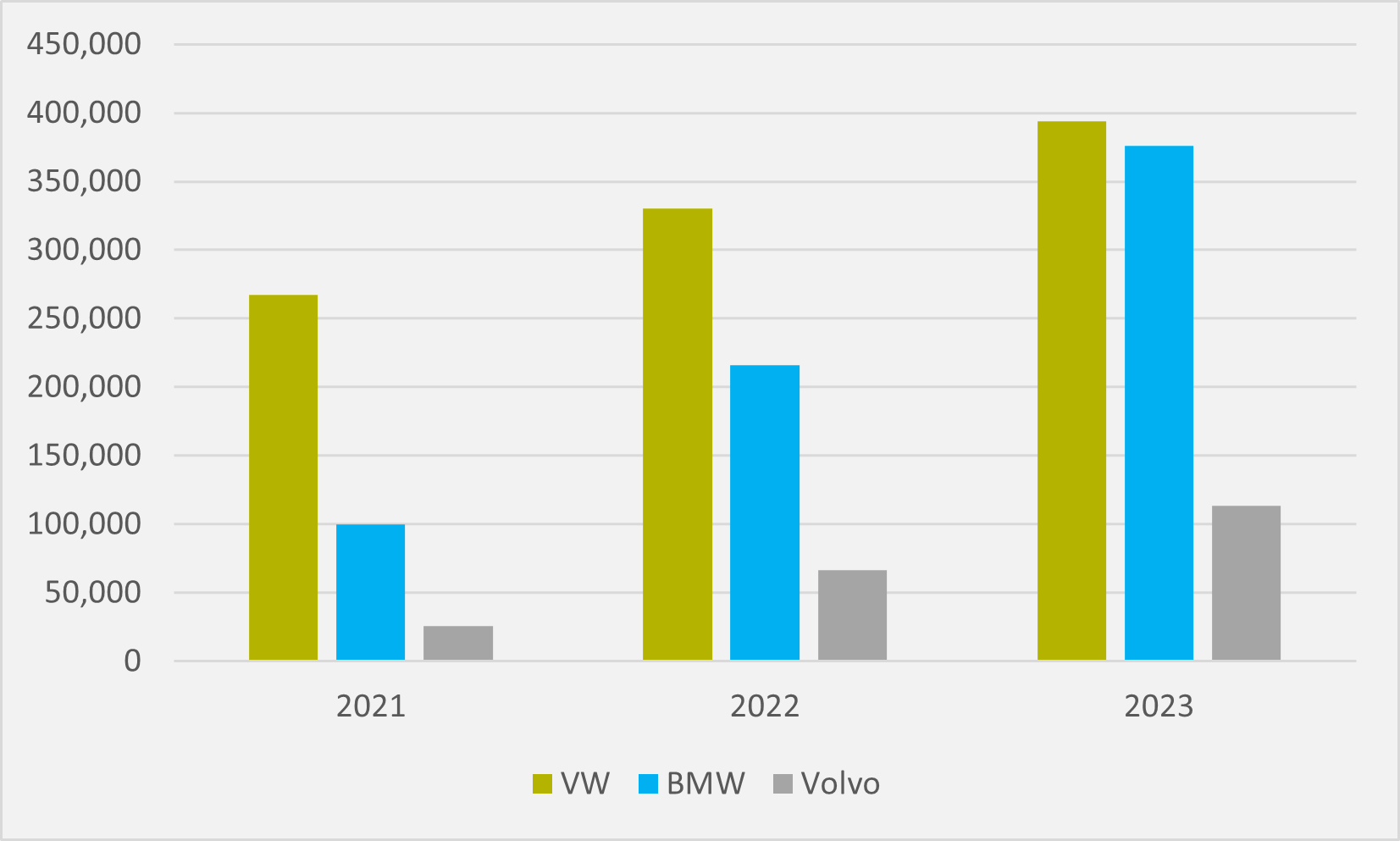

Bavaria’s BMW grew its global all-electric sales by 74.4pc in 2023. In contrast, VW saw its BEV sales rise by only 21.1pc, slashing the Wolfsburg-headquartered firm’s lead over its southeast German rival.

BMW BEV volumes hit 376,183 last year, in comparison to just 215,517 in 2022. VW’s sales remained higher, at c.394,000, up from c.330,000 in the previous 12 months (see Fig.1).

But this means that a gap of almost 115,000 extra VW BEV deliveries in 2023 narrowed to less than 20,000 in 2023 (see main image). In 2021, VW sold more than 165,000 BEVs more than its German rival.

And the data seems to back up BMW’s claim that “its sales of fully electric vehicles for the year 2023 significantly outperformed the total market for fully electric vehicles, underlining the company's role as an e-mobility pioneer”.

The premium segment was particularly important for the firm, with 330,596 units — or 88pc of its total BEV deliveries — falling into this category. Its growth was also higher than BMW’s overall year-on-year BEV expansion at 92.2pc. It identifies the iX1 and i4 as key BEV sales drivers.

Sales of fully electric Minis also rose, but only by 3.5pc year-on-year to 45,261 units. BMW will expand the brand’s BEV range in 2024 with the Mini Cooper SE and Mini Cooper E being joined by two further fully electric models, the Mini Countryman SE and the Mini Countryman E. The yet-to-be-unveiled new MINI Aceman, a compact five-seater crossover, will also be a BEV.

Further growth

And the firm remains bullish about the year to come, expressing confidence that “it will be able to maintain its BEV growth trajectory in 2024”. It trumpets a range of 18 fully electric models spanning all its brands’ main segments.

BMW predicts that one in every five of the company’s newly delivered vehicles in 2024 will be a BEV, rising to one in four by 2025. Based on repeating 2023’s overall sales, that would mean BEV deliveries rising to c.510,000 in 2024 and almost 640,000 in 2025.

“We see continued high demand for our fully electric products and — based on our strong, cross-brand product portfolio — expect to sell more than half a million fully-electric vehicles in 2024“, says Jochen Goller, customer, brands and sales member of BMW’s management board.

More sluggish

While VW’s overall BEV delivery increase was much more muted than BMW’s, the firm did identify some areas of higher growth. For its ID.4, year-on-year sales in Germany jumped by almost 63pc to c.30,000 and by over 84pc to c.38,000 in the US.

And, in China, ID.3 sales were up by over 200pc to 75,000+. China was VW’s largest national BEV market in 2023, followed by Germany, the US, the UK, Sweden, France, Norway and Belgium.

Another European OEM enjoying strong annual BEV growth in 2023 was Sweden’s Volvo, albeit from a lower base and with the edge that having a Chinese parent can give in the EV space. Its 2023 deliveries grew by 70pc year-on-year to 113,419 units.

Sales of fully electric cars accounted for 16pc of all Volvo cars sold globally during 2023, up from 10.9pc in 2022 — compared to 14.7pc for BMW and 12.4pc for VW.

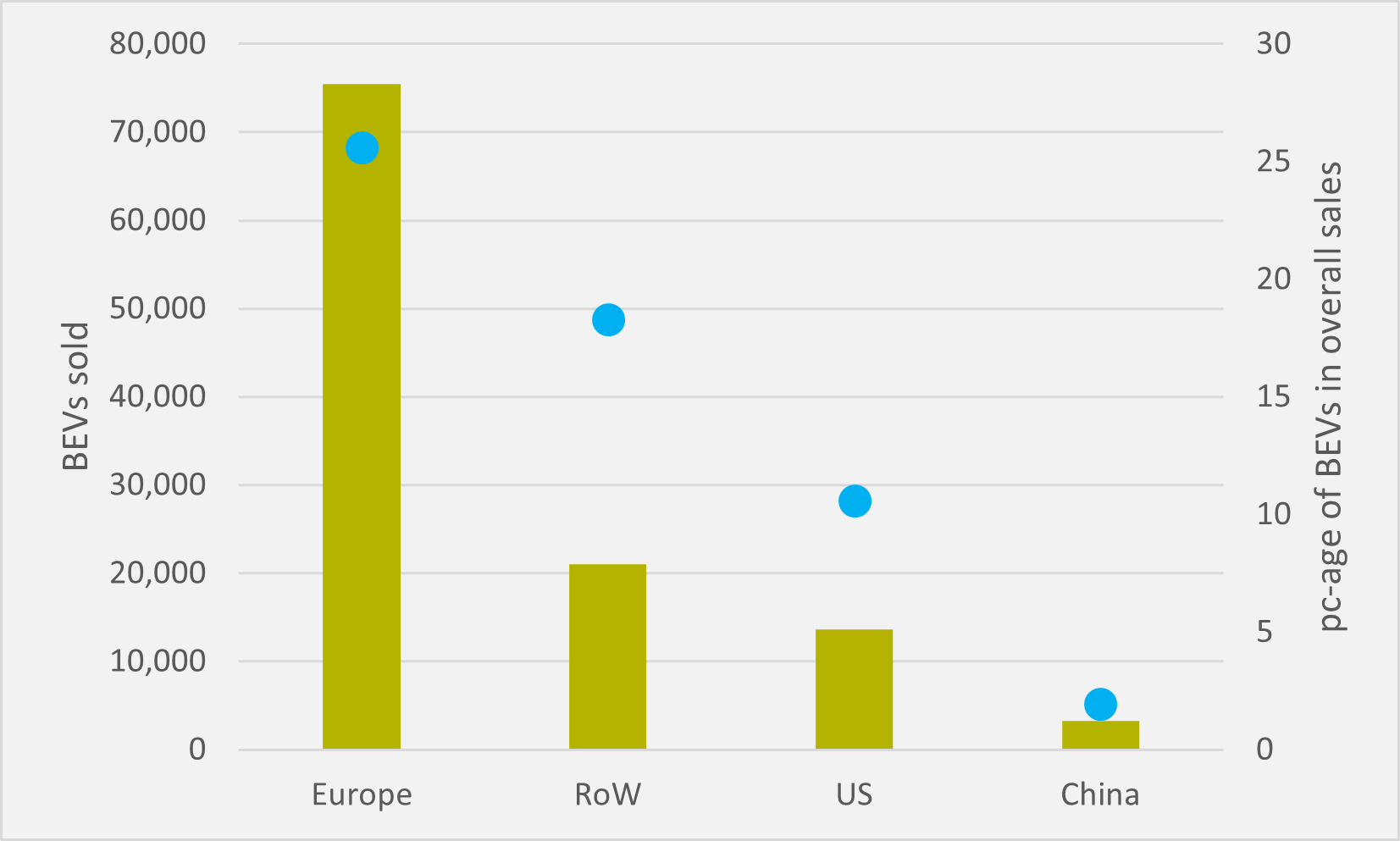

There is significant regional variation in BEV penetration of Volvo’s sales mix, with Europe — the firm’s largest market — seeing more than a quarter of Volvos sold being fully electric (see Fig.2). And BEVs have an 18.3pc share of Volvo sales outside of Europe, the US and China.

But only one in ten of its US sales is BEV. And, for China, that drops down to less than 2pc of sales, reflecting the huge challenges that Western OEMs have competing in the cut-throat Chinese BEV market.

Insider Focus LTD (Company #14789403)