Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

The Japanese legacy OEM is around two-thirds reliant on hybrids in Europe

The view of Japan's Toyota that hybrids will provide a future option for car buyers far into the future becomes less surprising when one looks at the breakdown of its European sales.

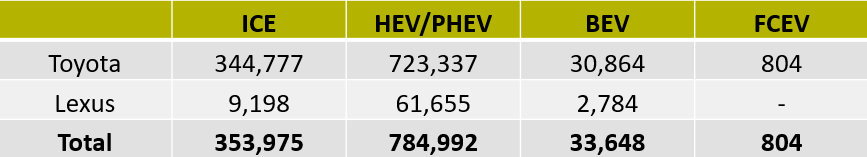

The firm's flagship Toyota brand recorded a 7pc year-on-year rise in total European new sales of passenger cars and commercial vehicles to just shy of 1,100,000 last year. Growth in sales of electrified vehicles was stronger, rising by 11pc to 755,005 units.

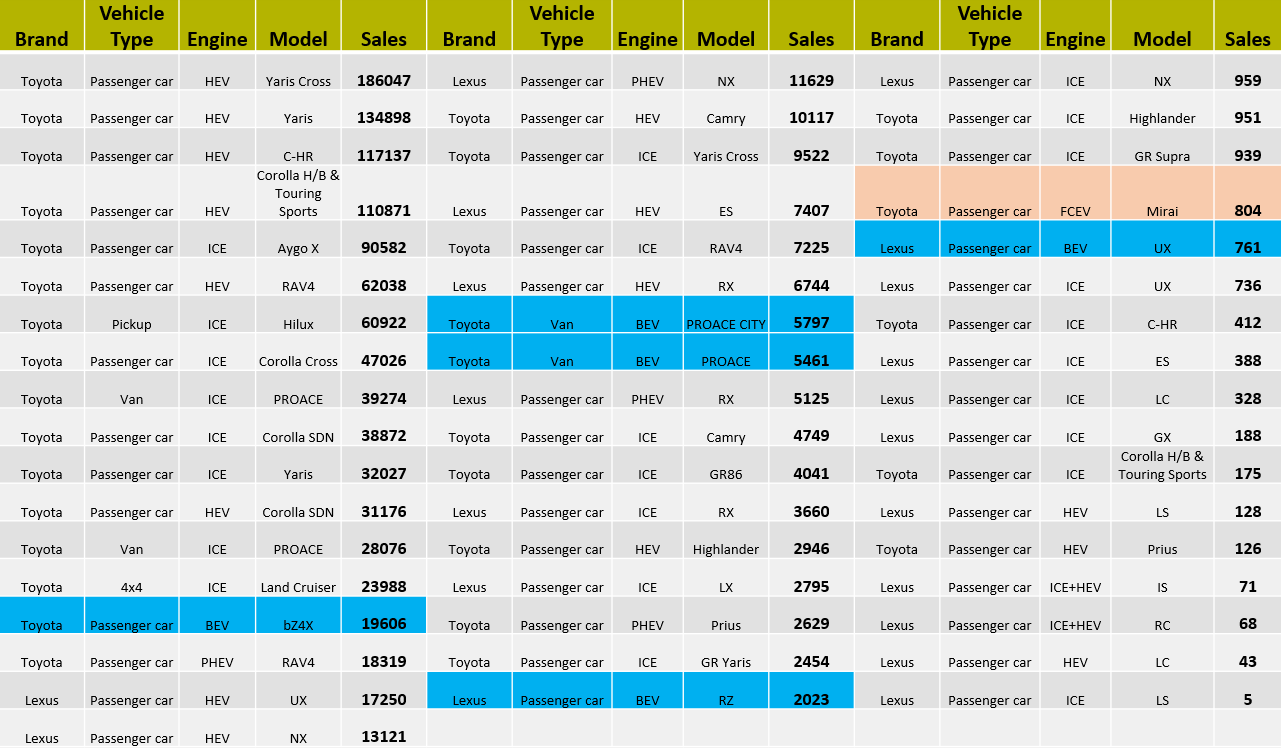

But of these electrified vehicles, only 19,606, or 1.78pc of the Toyota brand's overall sales, were its bZ4X, the marque's only passenger BEV — which it is upgrading to try to boost appeal. The firm's Proace and Proace City all-electric vans also shifted a combined 11,258 units .

By EV inFocus' calculations, that gives a total of 30,777 BEVs sold (see main image), or just 2.8pc of the Toyota marque's overall European sales.

In contrast, Toyota's ICE vehicle sales total 344,581, or 31.4pc of Toyota brand sales, while a 65.8pc majority of units (723,337) sold in Europe under the marque are some variety of hybrid.

Toyota's luxury brand Lexus leans even further into hybrids, with its 61,655 HEVs and PHEVs sold, representing 83.7pc of a total 73,637 units (see Fig.1).

Lexus' two BEV models, the UX and RZ, make up a slightly higher percentage of Lexus sales than all-electric does for the Toyota brand, albeit still only 3.8pc of the mix on a combined 2,784 BEVs sold.

West-east split

The share of ICE vehicles in Lexus' sales is squeezed even further than for the Toyota brand, at just 12.5pc and less than 10,000 units. In western Europe, that share falls to zero, whereas in sharp contrast the mix in eastern Europe — in which Toyota includes Turkey, Israel, Ukraine, Kazakhstan, Armenia, Azerbaijan and Georgia — the mix is 70pc ICE/30pc electrified.

This same geographical split is seen, slightly less markedly, for the Toyota marque, which see 75pc of western European buyers opt for electrified, but only 42pc further east.

Logic

Given that all four of Toyota's models that sold over 100,000 units in Europe in 2023 are HEVs (see Fig.2), and a further seven of its top-20 best sellers are either HEV or PHEV, it makes sense for Toyota to extoll the virtues of the technology. In contrast, the sometimes criticised bZ4X comes in 15th, shifting barely more than one-in-10 of the best-selling Yaris Cross HEV.

But where logic goes out the window in terms of Toyota's messaging is its continuing advocacy for hydrogen as a solution for passenger vehicles. Its Mirai FCEV sold just 804 units in Europe in 2023, representing a measly 0.07pc of Toyota brand sales.

Insider Focus LTD (Company #14789403)