No Kathleen Valley stope this month – Liontown

The firm is aiming to shift to underground production next month, and maintains everything is on schedule

Musk's "white supremacism" harming the brand, says one Tesla watcher

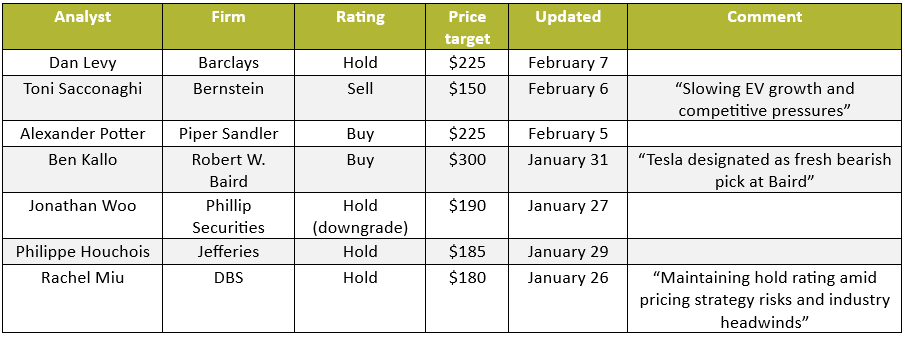

A host of automotive and technology equity analysts have issued ratings on Elon Musk-led EV market leader Tesla since the firm's fourth quarter results call. And while most have held their recommendations steady, two analysts have downgraded their views of the US EV firm.

One such downgrade is from Daiwa Capital Markets, which has cut Tesla to Neutral with a price target of $195 (slightly above Tesla's price as of writing), citing "corporate governance concerns aggravating already tough financial conditions in 2024".

This is the latest industry commentor to raise the question of whether CEO Musk's behaviour is harming the Tesla brand, a thread also taken up by Ross Gerber, CEO of Kawasaki Capital Management.

"Finally the cost of Elon's behaviour is hurting shareholders and it is really unfortunate because the reason we are even holding the stock is that Tesla's long-term potential is immense, so it is this catch-22," says Gerber.

Tesla shares have slumped by 25pc since the beginning of 2024, now sitting at around $187, and Gerber believes brand damage inflicted by Musk himself is a factor.

"One must accept that Elon's white supremacist motivations are absolutely damaging the brand because he is equated with Tesla," Gerber says.

There are, though, more fundamental factors limiting Tesla valuation currently. Broadly speaking a slowdown in EV demand — combined with Tesla admitting it is between two growth waves — leads to a prevailing view amongst analysts that EV sales at the company will be steady but not spectacular for at least the next year.

But Tesla presents a challenge for valuation projection because it is an umbrella of three separate businesses with distinct revenue streams. As well as automotive sales, Tesla makes a chunk of its revenue from its charging business, and its most profitable division is currently its energy generation and storage arm.

In truth, Tesla's varied businesses make the company a unique challenge for analysts formulating valuation projections. Bullish projections largely revolve around the potential monetisation of the firm's FSD and Autopilot features and monopolisation of the US charging market, while even more forward-looking value propositions focus on the potential of the firm's humanoid robot Optimus.

As such, the divergence of opinion among analysts is reflected by variance of not only the ratings but also the variance of their price targets.

The lowest price target, $150/share, is exactly half of the highest, reflecting significant divergence in analysts' valuing of the firm.

Enjoying EV inFocus? Hit follow on Google News to get us in your feed.

But analysts are largely united on sluggish automotive revenue growth for Tesla until its next-generation Model 2 affordable EV hits the market, which is currently earmarked for 2026.

"It looks to be the second half of 2025 before revenue growth will accelerate. In the near-term, shares will likely drift lower in what will be a vacuum of good news. By mid-year, details of the next-gen platform will arrive and anticipation of new models should mark a positive turning point in Tesla shares," says advisory firm Deepwater Capital Markets.

Insider Focus LTD (Company #14789403)