Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

The Japanese firm is moving new cells into mass production and signing new OEM collaborations

How Japan’s Panasonic Energy has fared against its competitors in the global battery making market speaks to two negative trends in the wider EV space: the struggles of Tesla; and Japanese OEM indifference to developing competitive BEV offerings. But the firm is now trying to reverse its fortunes.

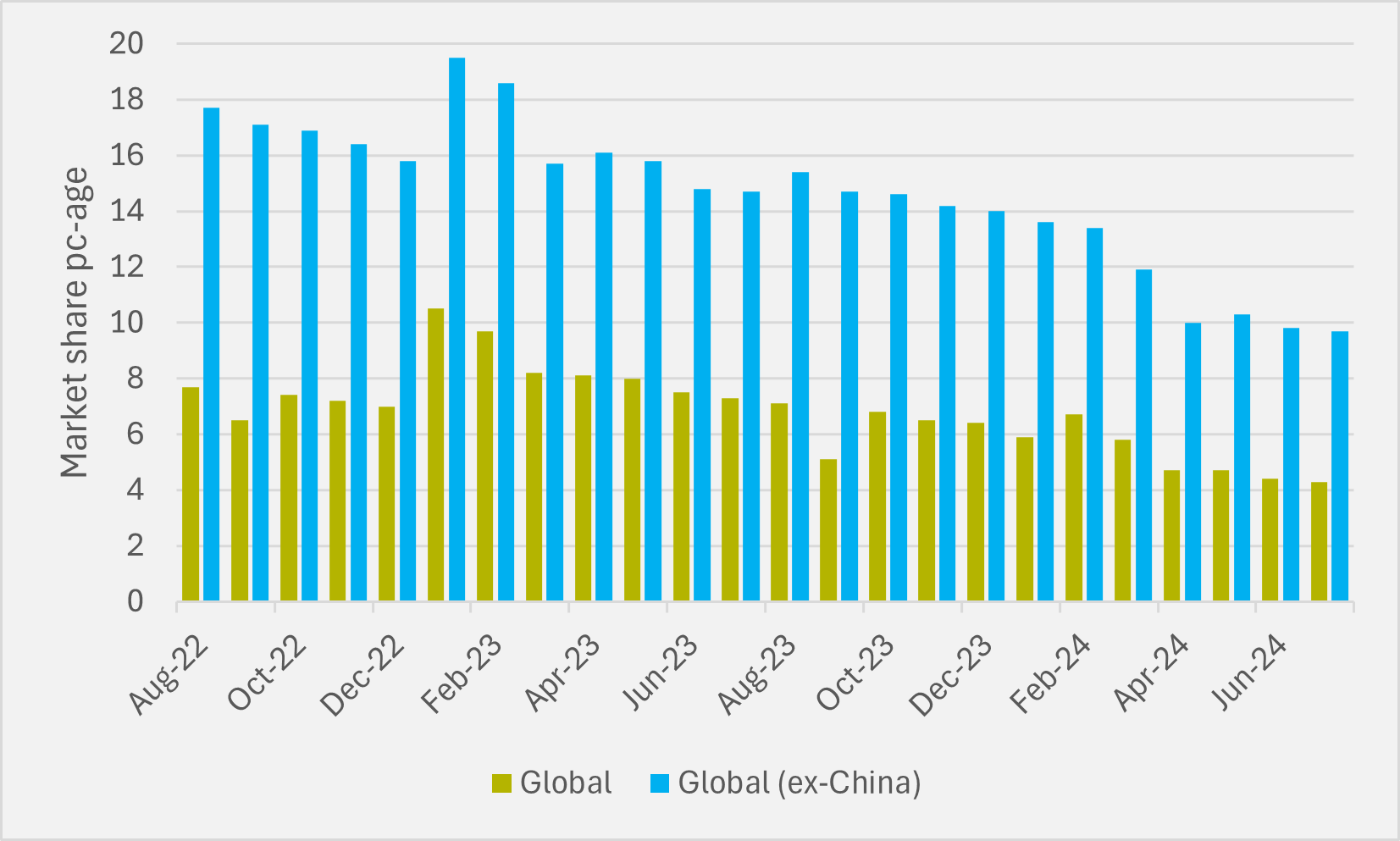

According to South Korean consultancy SNE Research, Panasonic’s share of the EV battery market has been on a downtrend since early last year, with no sign yet of a recovery. At the end of January 2023, SNE put the Japanese firm’s share of the overall global market above 10pc and its slice of the pie outside China at 20pc+.

Since then, Panasonic has shed market share at an alarming rate. At the end of July, SNE put its overall global and ex-China percentages at under 10pc and sub-5pc (see Fig.1). In other words, Panasonic’s market share has more than halved in eighteen months.

The most recent SNE data puts Panasonic EV batteries’ cumulative non-China usage at 18.8GWh in the first seven months of 20024, down by more than 25pc from 25.2GWh in the same period last year, despite overall usage having expanded by 12.6pc. The consultancy attributes the majority of Panasonic’s woes to “a slowdown in sales of Tesla Model 3, due to its transformation to the facelifted version earlier this year”.

“As sales of Model 3 have recently expanded and Panasonic was reported to launch advanced 2170 and 4680 cells supplied to Tesla, Panasonic is expected to rapidly regain its market share mainly focusing on Tesla,” it predicts.

Late last year, Panasonic itself flagged that slowing demand for Tesla's higher-end Model S and Model X vehicles was impacting demand for its batteries.

Ready to go

But the battery maker has just announced milestone progress on one of the major recovery drivers seen by SNE, as it has “finalised preparations for mass production of the 4680 cylindrical automotive lithium-ion batteries, marking a much-anticipated breakthrough in the industry”.

The firm has also revamped its Wakayama factory in western Japan, which will serve as the main base factory for the new cells. Mass production is set to start after a final evaluation.

Panasonic says that the 4680 “offers substantial improvements over conventional 2170 cells”, including possessing five times the capacity of the 2170. This promises to extend the driving range of EVs, and also reduce the number of cells required for the same battery pack capacity — resulting in more efficient battery pack assembly process and, ultimately, lower-cost EVs.

The firm is also committed to improving the capacity of its 2170 cells. But it has previously admitted that it has had to scale back Japanese battery production.

The Wakayama plant will also serve as a demonstration hub for new products and methods, with processes trialled there then implemented globally in other Panasonic factories. By next March, it expects c.400 staff will be involved in the development and production of next-generation batteries at Wakayama.

"I am excited that we are ready to start the mass production of the cutting-edge 4680 cell,” says Panasonic Energy CEO Kazuo Tadanobu. “I am confident it will significantly revolutionise the battery and EV industry. As we add the 4680 cell to our line-up, we will cater to a broader range of needs, further promoting the use of EVs.”

New partners

Panasonic is also hoping to reduce its dependence on Tesla by partnering with domestic OEMs, as they finally wake up to their relative failure thus far to develop BEVs and their value chains. It has inked partnership agreements with Subaru and Mazda, as part of a wider Japanese government investment programme to increase EV battery capacity that also includes Toyota and Nissan.

Panasonic and Subaru will jointly establish a new battery factory in Oizumi, Gunma Prefecture, to supply batteries to help meet the OEM’s target of 50pc of its 1.2mn global sales in 2030 being BEVs. Before it is completed in the April ’28-Mar ’29 fiscal year, the battery maker will supply Sabura with batteries for its new BEV launches planned in the second half of the decade from its Suminoe factory in Osaka, starting from fiscal year 27-28.

Annual production capacity for battery cells linked to the Subaru co-operation at the two plants is planned to reach 20GWh by 2030, Panasonic says.

While having done virtually nothing in the all-electric space thus far, “Subaru is accelerating its efforts toward electrification”, says the firm’s CEO Atsushi Osaki. "Through this collaboration, we are poised to drive the expansion of EVs,” says Kazuo Tadanobu, Panasonic Energy CEO.

And his firm has signed a similar deal with Mazda, which is planning BEV launches from 2027 onwards. Panasonic will also supply Mazda from Suminoe, as well as from Kaizuka, another Osaka plant. The volume of the Mazda supply is, though, expected to be smaller, at 10GWh by 2030.

As well as driving increased BEV penetration, Tadanobu adds of the Mazda deal that it will “boost the competitiveness of Japan’s battery industry”.

“We will make the most of the highly efficient, high-performance and safe batteries supplied by Panasonic Energy, and deliver distinctive Mazda BEVs to our customers that perfectly balance design, convenience, and driving range," says Mazda CEO Masahiro Moro.

The two deals are part of a new lithium-ion battery supply plan approved this month by Japan’s Ministry of Economy, Trade and Industry. The Panasonic-Subaru part of the package is targeting additional production capacity of 16GWh/yr by 2030. The Japanese government will offer up to ¥156.4bn ($1.1bn) in subsidies, aiming to unlock total investment of c.¥463bn.

The Panasonic-Mazda deal calls for an additional 6.5GWh/yr of capacity by end of decade. Promised subsidies are up to ¥28.3bn, as part of total investment of c.¥83.3bn.

Insider Focus LTD (Company #14789403)